LNG Market Outlook – Now And In The Future

The LNG market outlook today

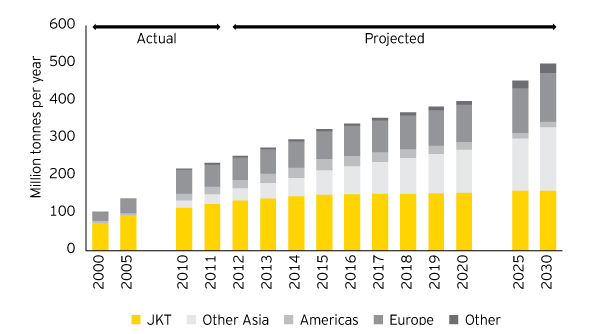

In an assessment done by Ernst & Young, it was estimated that global natural gas demand has grown 2.7% annually since 2000. However, global LNG demand has risen by an estimated 7.6% per year over the same period, a growth that is three times faster than the former, and the growth is expected to increase even further in recent year, especially through 2020.

Image taken from Ernst & Young Global Limited

As an alternative source of gas supply, the increase in LNG demand is a function of increasing natural gas consumption that is driven by economic growth and fuel switching. According to Shell’s first LNG Outlook, it was highlighted that the demand has increased with the addition of six new importing countries namely, Columbia, Egypt, Jamaica, Jordan, Pakistan and Poland. The number of LNG importers has increased to 35 from 10 since 2000, with India and China as the two fastest growing buyers.

Key driving factors of the current LNG market

With that said, there are a couple of key driving factors that caused the growth of LNG industry today:-

The future of LNG market

As the LNG industry become larger and more diverse, it also increased its unpredictability and complexity. Demand patterns are changing with the continuous increased in LNG buyers. Countries with import facilities have doubled in the past decade, and it is expected to double again, aided by low-cost and small scale floating regasification plants. Regasification technology, will outnumber new fixed onshore plants by a wide margin.

Currently, Asia accounts for more than half of global LNG imports, with Japan, South Korea and China in the lead, occupying over half of the global market share. The emergence of new regasification markets has allowed LNG companies to see the untapped potential in them, and the need to adapt to new market forces.

“The Asian market has always led the way in terms of LNG imports, and will continue to do so to a certain extent. However, the shift in global development is leading to a rise in demand from countries that have previously been overlooked. It is essential that LNG companies are agile, to ensure that they are able to cater to the needs of new players.” – Orson Francesone, Vice President of DMG Events Global Energy

There will be fewer large greenfield LNG projects as the smaller LNG players that offer more modular structures will be preferred due to their flexibility in the capital markets. Multiple pricing models will emerge as more organisations incorporate hybrid pricing formulas that reflect continental pricing or pricing based on emerging LNG hubs. Contract duration will shrink, and there will be more space and flexibility for price comparison, destination restrictions will be loosened as well.

Outlook for LNG markets is positive, and demand is still expected to grow in the next couple of decades.

Opus Kinetic believes that people are why organisations are successful, and giving people the knowledge to perform well at their job is integral for success. We pride ourselves as the premier provider of knowledge, offering acclaimed in-house training, leadership training courses, oil and gas training courses, courses that target health safety and environment, etc. Our training courses are well researched and updated with the latest industry trends. For more information on our professional training programs, you can visit us at http://www.opuskinetic.com/training.