Following three painful years of portfolio repositioning, cost cuts, and deferred projects, the offshore oil and gas industry is now more prepared to deliver projects and profits at lower costs and simpler designs.

Currently, U.S. shale is taking center stage in analyses about oil growth stories, and rightfully so — it’s growing at a much faster pace than previously expected. But cost inflation and investor pressure to prefer profits over production may slow down the pace of that growth going forward.

Meanwhile, offshore oil — which suffered from slashed investments during the downturn — is now coming back with projects that have improved economics, in some cases challenging those of U.S. shale. That’s due to the costs that major oil companies slashed after 2014, to simpler designs, and to the supermajors reshaping portfolios and projects to make as much money at $60 Brent as they were making at $100 Brent four years ago.

According to analysts at Bernstein, some 40 new offshore projects could be approved this year, a significant rise compared with 29 projects approved last year and with just 14 projects in 2016, which, according to Reuters data, was the lowest number since at least 1990. Most of the new offshore projects are also expected to be leaner and smaller and average 42,000 bpd of oil equivalents, compared to 69,000 bpd for last year’s projects, according to Bernstein.

Oil majors have already announced some impressive cost reductions in offshore projects.

Shell said last month that it would redevelop the Penguins oil and gas field in the UK North Sea, with a go-forward break-even price below $40 per barrel and peak production at around 45,000 bpd.

Then Statoil said earlier this month that it had reduced the breakeven for the first phase of its Johan Sverdrup offshore project to below $15 per barrel.

Related: Oil Rig Count Rises As Prices Recover

“Their focus on simplification, design enhancements and execution efficiencies have made their offshore prospects competitive with North American shale projects,” Matthew Fitzsimmons, VP Cost Analysis at Rystad Energy, said, commenting on the Johan Sverdrup cost reduction.

“Much is made of the Permian, its flexibility and the returns there. But actually infill drilling for a decade creates enormous sources of money,” Bernard Looney, head of BP’s upstream division, told Reuters.

“You will see more deepwater over time, for sure,” Looney noted.

Offshore development is needed if the industry is to offset the natural decline of currently producing oil fields, because even with the production boom, shale accounts for just 7 percent of the global oil supply of 98 million bpd, whereas offshore oil makes up more than one-quarter of supply.

There are signs that optimism is returning to the upstream, and companies will continue to prefer low-cost high-value oil developments this year, according to energy consultancy Wood Mackenzie.

Oil majors and national oil companies (NOCs) are expected to compete fiercely for discovered resource opportunities offshore Brazil, “bolstered by world-class deepwater economics,” WoodMac says, expecting Mexico’s licensing rounds to draw strong bidding this year as well.

Deepwater Gulf of Mexico, which was badly bruised during the downturn, is also expected to stage a comeback this year, Wood Mackenzie reckons. The U.S. tax overhaul “drastically increased the fiscal competitiveness of deepwater Gulf of Mexico, relative to other offshore basins,” WoodMac said.

Still, current production in the Gulf of Mexico can’t be sustained with conventional deepwater fields, William Turner, Wood Mackenzie’s senior research analyst and lead author of the “Deepwater GoM: 5 Things to Look for in 2018” insight, said.

Related: Is This The Future For OPEC?

“Increased investments in exploration and development, especially in ultra high-pressure high-temperature technologies and projects, are crucial not only to maintaining the current pace of production but also in unlocking the next phase of significant volumes in the region,” Turner noted.

As a result of the oil price crash, global offshore investments have plunged from the 2014 highs of $335 billion, as companies had to reassess how to make higher-cost projects profitable in the lower oil price world, Rystad Energy says. The sentiment turned positive in 2017 and this year will be the bottom of the global offshore investments at $155 billion, before investments start to grow steadily year by year going forward.

“This growth comes from high offshore activity, driven mainly by an increasing oil price and companies’ ability to cut costs to improve the profitability of their projects,” Emil Varre Sandøy at Rystad Energy said.

By 2022, offshore investments will manage to recover to $230 billion, which will still be 25 percent lower than the 2014 high, but which will show that the industry will stick to strict cost management, Rystad says.

By Tsvetana Paraskova for Oilprice.com

News Source : Link

Read MoreNuclear power is in crisis ‒ as even the most strident nuclear enthusiasts acknowledge ‒ and it is likely that a new era is fast emerging, writes Jim Green, editor of the Nuclear Monitor newsletter. After a growth spurt from the 1960s to the ’90s, then 20 years of stagnation, the Era of Nuclear Decommissioning is upon us. Article courtesy Nuclear Monitor.

Last year was supposed to be a good year for nuclear power ‒ the peak of a mini-renaissance resulting from a large number of reactor construction starts in the three years before the Fukushima disaster. The World Nuclear Association (WNA) anticipated 19 reactor grid connections (start-ups) in 2017 but in fact there were only four start-ups (Chasnupp-4 in Pakistan; Fuqing-4, Yangjiang-4 and Tianwan-3 in China).

The four start-ups were outnumbered by five permanent shut-downs (Kori-1 in South Korea; Oskashamn-1 in Sweden; Gundremmingen-B in Germany; Ohi 1 and 2 in Japan).

The WNA’s estimate for reactor start-ups in 2017 was hopelessly wrong but, for what it’s worth, here are the Association’s projections for start-ups in the coming years:

2018‒19: 30

2020‒21: 12

2022‒23: 9

2024‒25: 2

Thus ‒ notwithstanding the low number of start-ups in 2017 ‒ the mini-renaissance that gathered steam in the three years before the Fukushima disaster probably has two or three years to run. Beyond that, it’s near-impossible to see start-ups outpacing closures.

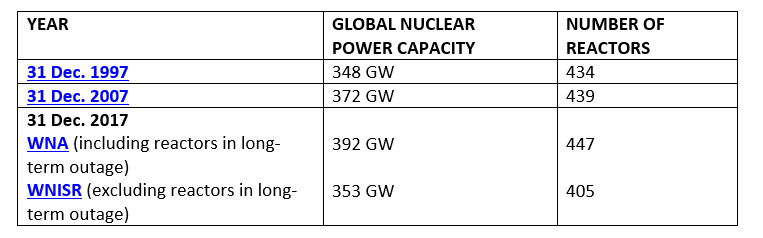

New nuclear capacity of 3.3 gigawatts (GW) in 2017 was outweighed by lost capacity of 4.6 GW. Over the past 20 years, there has been modest growth (12.6%, 44 GW) in global nuclear power capacity if reactors currently in long-term outage are included. However, including those reactors ‒ in particular idle reactors in Japan, many of which will never restart ‒ in the count of ‘operable’ or ‘operational’ or ‘operating’ reactors is, as former WNA executive Steve Kidd states, “misleading” and “clearly ridiculous”.

There would need to be an average of 10 reactor start-ups (10 GW) per year just to maintain current capacity. The industry will have to run hard just to stand still

The World Nuclear Industry Status Report (WNISR) excludes reactors in long-term outage ‒ defined as reactors that produced zero power in the previous calendar year and in the first half of the current calendar year ‒ from its count of operating reactors. Thirty-six reactors are currently in long-term outage, 31 of them in Japan.

Excluding reactors in long-term outage, the number of reactors has declined by 29 over the past 20 years, while capacity has grown by a negligible 1.4% (5 GW). Over the past decade, the reactor count is down by 34 and capacity is down by 9.5% (19 GW).

The industry faces severe problems, not least the ageing of the global reactor fleet. The average age of the reactor fleet continues to rise, and by mid-2017 stood at 29.3 years; over half have operated for 31 years or more.

The International Energy Agency expects a “wave of retirements of ageing nuclear reactors” and an “unprecedented rate of decommissioning” ‒ almost 200 reactor shut-downs between 2014 and 2040. The International Atomic Energy Agency anticipates 320 GW of retirements by 2050 ‒ in other words, there would need to be an average of 10 reactor start-ups (10 GW) per year just to maintain current capacity. The industry will have to run hard just to stand still.

Renewables (24.5% of global generation) generate more than twice as much electricity as nuclear power (<10.5%) and the gap is growing rapidly

Assuming the mini-renaissance doesn’t continue to flop (as it did in 2017), an average of 10 or so start-ups from 2015‒2020 is possible (there were 24 start-ups from 2015‒17). But to maintain that level, the number of construction starts would need to increase sharply and there is no likelihood of that eventuating ‒ there have only been seven construction starts in the past two years combined.

The number of reactors under construction is slowly dropping. Using WNA figures, 71 reactors were under construction in January 2014 compared to 58 in January 2018. According to WNISR figures, the number is down from 67 to 52 over the same period. That trend seems certain to continue because of a sharp drop in reactor construction starts: 38 from 2008‒2010 compared to 39 in the seven years from 2011‒2017.

Nuclear power accounted for 10.5% of global electricity generation in 2016 (presumably a little less now), well down from the historic peak of 17.5% in 1996.

Renewables (24.5% of global generation) generate more than twice as much electricity as nuclear power (<10.5%) and the gap is growing rapidly. The International Energy Agency predicts renewable energy capacity growth of 43% (920 GW) from 2017 to 2022. Overall, the share of renewables in power generation will reach 30% in 2022 according to the IEA. By then, nuclear’s share will be around 10% and renewables will be out-generating nuclear by a factor of three.

A disastrous year for the nuclear industry

Last year was “all in all a disastrous year” for the nuclear power industry according to Energy Post Weekly editor Karel Beckman. Nuclear lobbyists issued any number of warnings about nuclear power’s “rapidly accelerating crisis“, a “crisis that threatens the death of nuclear energy in the West“, “the crisis that the nuclear industry is presently facing in developed countries“, the “ashes of today’s dying industry”, and noting that “the industry is on life support in the United States and other developed economies“.

Lobbyists engaged each other in heated arguments over possible solutions to nuclear power’s crisis ‒ in a nutshell, some favour industry consolidation while others think innovation is essential, all of them think that taxpayer subsidies need to be massively increased, and none of them are interested in the tedious work of building public support by strengthening nuclear safety and regulatory standards, strengthening the safeguards system, etc.

One indication of the industry’s desperation has been the recent willingness of industry bodies (such as the US Nuclear Energy Institute) and supporters (such as former US energy secretary Ernest Moniz) to openly acknowledge the connections between nuclear power and weapons, and using those connections as an argument for increased taxpayer subsidies for nuclear power and the broader ‘civil’ nuclear fuel cycle. The power/weapons connections are also evident with Saudi Arabia’s plan to introduce nuclear power and the regime’s pursuit of a weapons capability.

There were no commercial reactor construction starts in China in 2017 (though work began on one demonstration fast neutron reactor) and only two in 2016

The biggest disaster for the nuclear industry in 2017 was the bankruptcy filing of Westinghouse ‒ which also came close to bankrupting its parent company Toshiba ‒ and the decision to abandontwo partially-built reactors in South Carolina after the expenditure of at least US$9 billion. As of January 2018, both Westinghouse and Toshiba are still undergoing slow and painful restructuring processes, and both companies are firmly committed to exiting the reactor construction business (but not the nuclear industry altogether).

Another alarming development for the nuclear industry was the slow-down in China. China Nuclear Engineering Corp, the country’s leading nuclear construction firm, noted in early 2017 that the “Chinese nuclear industry has stepped into a declining cycle” because the “State Council approved very few new-build projects in the past years”.

There were no commercial reactor construction starts in China in 2017 (though work began on one demonstration fast neutron reactor) and only two in 2016. The pace will pick up but it seems less and less likely that growth in China will make up for the decline in the rest of the world.

The Era of Nuclear Decommissioning will be characterised by escalating battles (and escalating sticker shock) over lifespan extensions, decommissioning and nuclear waste management

The legislated plan to reduce France’s reliance on nuclear from 75% of electricity generation to 50% by 2025 seems unlikely to be realised but the government is resolved to steadily reduce reliance on nuclear in favour of renewables. French environment minister Nicolas Hulot saidin November 2017 that the 50% figure will be reached between 2030 and 2035. France’s nuclear industry is in its “worst situation ever”, a former EDF director said in November 2016, and the situation has worsened since then.

There were plenty of other serious problems for nuclear power around the world in 2017:

- Swiss voters supported a nuclear phase-out referendum.

- South Korea’s new government will halt plans to build new nuclear power plants (though construction of two partially-built reactors will proceed, and South Korea will still bid for reactor projects overseas).

- Taiwan’s Cabinet reiterated the government’s resolve to phase out nuclear power by 2025 though a long battle

- Japan’s nuclear industry has been decimated ‒ just five reactors are operating (less than one-tenth of the pre-Fukushima fleet) and 14 reactors have been permanently shut-down since the Fukushima disaster (including the six Fukushima Daiichi reactors).

- India’s nuclear industry keeps promising the world and delivering very little ‒ nuclear capacity is just 6.2 GW. In May 2017, India’s Cabinet approved a plan to build 10 indigenous pressurised heavy water reactors, but most have been in the pipeline for years and it’s anyone’s guess how many (if any) will actually be built.

- The UK’s nuclear power program faces “something of a crisis” according to an industry lobbyist. The reactor fleet is ageing but only two new reactors are under construction. The estimated cost of the two Hinkley Point reactors, including finance, is A$40 billion.

- All of Germany’s reactors will be closed by the end of 2022 and all of Belgium’s will be closed by the end of 2025.

- Russia’s Rosatom began construction of the first nuclear power reactor in Bangladesh, signed agreements to build Egypt’s first power reactors, and is set to begin work on Turkey’s first reactors ‒ but Rosatom deputy general director Vyacheslav Pershukov said in June 2017 that the possibilities for building new large reactors abroad are almost exhausted. He said Rosatom expects to be able to find customers for new reactors until 2020‒2025 but “it will be hard to continue.”

- A High Court judgement in South Africa in April 2017 ruled that much of the country’s nuclear new-build program is without legal foundation, and there is little likelihood that the program will be revived given that it is shrouded in corruption scandals and President Jacob Zuma’s hold on power is weakening.

The only nuclear industry that is booming is decommissioning ‒ the World Nuclear Association anticipates US$111 billion worth of decommissioning projects to 2035.

The Era of Nuclear Decommissioning

The ageing of the global reactor fleet isn’t yet a crisis for the industry, but it is heading that way. In many countries with nuclear power, the prospects for new reactors are dim and rear-guard battles are being fought to extend the lifespans of ageing reactors that are approaching or past their design date.

Perhaps the best characterisation of the global nuclear industry is that a new era is approaching ‒ the Era of Nuclear Decommissioning ‒ following on from its growth spurt from the 1960s to the ’90s then 20 years of stagnation.

The Era of Nuclear Decommissioning will entail:

- A slow decline in the number of operating reactors.

- An increasingly unreliable and accident-prone reactor fleet as ageing sets in.

- Countless battles over lifespan extensions for ageing reactors.

- An internationalisation of anti-nuclear opposition as neighbouring countries object to the continued operation of ageing reactors (international opposition to Belgium’s ageing reactors is a case in point ‒ and there are numerous other examples).

- Battles over and problems with decommissioning projects (e.g. the UK government’s £100+ million settlement over a botched decommissioning tendering process).

- Battles over taxpayer bailout proposals for companies and utilities that haven’t set aside adequate funds for decommissioning and nuclear waste management and disposal. (According to Nuclear Energy Insider, European nuclear utilities face “significant and urgent challenges” with over a third of the continent’s nuclear plants to be shut down by 2025, and utilities facing a €118 billion shortfall in decommissioning and waste management funds.)

- Battles over proposals to impose nuclear waste repositories and stores on unwilling or divided communities.

The Era of Nuclear Decommissioning will be characterised by escalating battles (and escalating sticker shock) over lifespan extensions, decommissioning and nuclear waste management. In those circumstances, it will become even more difficult than it currently is for the industry to pursue new reactor projects. A feedback loop could take hold and then the nuclear industry will be well and truly in crisis ‒ if it isn’t already.

News Source: Link

Read MoreAsian state-owned oil companies—and taxpayers in the Asia-Pacific—are facing a potential bill of up to US$100 billion for the decommissioning of tens of thousands of oil wells drilled during the oil boom in the 1970s and 1980s, Wood Mackenzie has warned as quoted by Bloomberg.

The numbers are staggering: 35,000 offshore wells, more than 2,500 platforms, and over 34,000 miles of pipelines across China, Thailand, Indonesia, Malaysia, and Australia. Wood Mac has estimated that this infrastructure amounts to 7.5 million tons of steel that have been exposed to petrochemical contaminants for decades.

But decommissioning in this part of the world is not as common a practice as it is in the North Sea or the Gulf of Mexico. Wood Mac’s analysts warn that if it is not done properly, decommissioning could cause environmental damages in a region where millions of people depend on the sea for their livelihood. At the same time, delaying the decommissioning because of lack of expertise could also lead to environmental damages resulting from breakdowns and equipment failures.

All this is easier said than done as the oil industry across the world still struggles with much lower oil prices than four years ago. What makes the Asia-Pacific well decommissioning problem even worse is the lack of adequate regulation. That’s true of all the countries in the region except Thailand and Australia.

Related: Big Oil Enters Growth Mode

Wood Mac’s analysts explained in their report that the best practice in this respect is for the driller to put money for decommissioning in an escrow account in the country that has leased the block. Yet this has not been done on a large enough scale in Asia-Pacific, and now companies may have to pay through the nose to plug the old wells.

As if this is not enough, the consultancy’s analysts note that even with proper planning and a stash of cash for well-plugging, the costs could end up being 10 times higher than initial calculations. This is what happened to BP when it had to decommission its Nile well: it cost it US$200 million, versus an initial estimate of US$20 million.

News Source: Link

Read MoreABU DHABI: Abu Dhabi National Oil Co (Adnoc) received bids in the fourth quarter from international energy companies seeking stakes in offshore fields that pump about 25 per cent of the UAE capital’s crude.

Adnoc is reviewing commercial bids from the companies it will choose from to help develop the deposits in a new joint venture, Adnoc said in response to questions.

Adnoc didn’t identify the bidders or say when it would make a decision. The existing venture expires in March.

Plans to expand production at the offshore block are part of Abu Dhabi’s effort to raise output capacity to 3.5 million barrels a day later this year from about 3.15 million currently. The new contracts will govern operations at the deposits for several decades. The fields currently produce about 700,000 barrels a day, with a target to pump 1 million barrels a day by 2021.

Middle Eastern producers are trying to wring more crude from ageing fields. With global demand seen rising about 2 per cent this year to about 100 million barrels a day, producers such as Abu Dhabi are turning to international partners, increasingly from oil-importing countries in Asia, to help boost their capacity to meet future demand. Abu Dhabi holds about 6 per cent of global crude reserves.

Under the contract for the new venture, international companies will no longer receive a fixed fee for each barrel of oil they produce, according to people with knowledge of the situation. Instead, the partners will receive shares of the oil produced at the fields and any profit from sales of the crude minus costs, taxes and royalties paid to the government, said the people, who asked not to be identified because the discussions are confidential.

In another change, the single offshore block will be divided into three parts, the people said. One area will contain the Lower Zakum field, a second will include the Umm Shaif and Nasr deposits and the third will comprise the Satah Al Razboot and Umm Lulu fields, they said. Adnoc didn’t comment about the new contract structure or the three-way partitioning of the block. Adnoc owns 60 per cent of the current partnership managing the fields, Abu Dhabi Marine Operating Co, known as Adma-Opco. BP holds 14.67 per cent of the venture, while Total SA owns 13.33 per cent and Inpex Corp of Japan has 12 per cent.

Inpex is interested in the new concession and is in negotiations, Tokyo-based spokesman Carlo Niederberger said by phone, without confirming whether it had submitted a bid. BP, Total, Statoil ASA and China National Petroleum Corp. are among companies that have expressed interest.

Meanwhile, Adnoc LNG is expected to award the EPC contract for phase II of the expansion of its integrated gas development (IGD) project by September this year, said Vinod Thakur, contract manager at Adnoc LPG. The company is an arm of Adnoc.

With regards to project financing, Thakur shared that the project is being financed by Adnoc itself. The project cost is estimated to be around $450 milion, as per industry metrics.

Tecnicas Reunidas SA, Petrofac Limited, National Petroleum Construction Company (NPCC), and Maire Tecnimont SpA had submitted their bids for the project.

News Source: Link

Read MoreSingapore’s central role in global LNG markets is unquestionable but the country’s long-term prospects faces huge challenges, says one oil and gas expert.

SINGAPORE: About 95 per cent of Singapore’s electricity is generated using natural gas.

Before the completion of Singapore’s first liquefied natural gas (LNG) terminal in 2013, the city’s only option was to import natural gas via pipelines from Malaysia and Indonesia.

Singapore’s LNG industry has boomed since then, powering gas cookers and water heaters in most households and fueling industries including refineries and petrochemicals.

Its LNG ambitions are massive, involving markets further afield. Singapore’s strategic location and reputation as a global trading hub for other commodities place it at the forefront of becoming Asia’s LNG trading hub.

But the city state faces several challenges as it persists tirelessly towards this goal.

EXPANDING LNG INDUSTRY

Singapore’s central role in LNG trading is unquestionable and is supported by an expanding LNG infrastructure, business-friendly regulation, and a strong and growing pool of industry talent.

And as the global supply expansion drives LNG towards becoming a global commodity in its own right, Singapore’s position as an LNG trading centre will grow too.

Nearly 40 companies have opened offices in Singapore – from traders, buyers and sellers looking to enhance optimisation capabilities, to companies offering supporting services such as lawyers, consultants and shipping firms – according to the Singapore Department of Statistics.

The country’s move to expand its LNG capacity to 11 million metric tonnes a year (mt/year) by 2018 and give international players access to storage and reload services demonstrates its commitment to become a regional facilitator of LNG trading.

Unlike other Asian buyers, Singapore has taken bold steps to develop a competitive and liberalised gas market, has access to international pipeline connections, and already allows third-party access to its gas and LNG infrastructure.

It has the support of its regulatory authorities and first-mover advantage relative to similar efforts by Japan and Shanghai to build their own LNG hubs.

Concerted efforts to create a Singapore-based pricing point for spot cargoes have also been made, in a bid to boost regional pricing transparency, and capitalise on the LNG industry’s departure from its traditional oil-indexed pricing model.

As LNG trading becomes more liquid in the physical and financial markets, industry participants feel more comfortable with pricing and hedging LNG cargoes not against an associated commodity like crude oil, but LNG itself.

LOW LIQUIDITY AND STORAGE BIGGEST CHALLENGES

Low liquidity will continue to be the biggest challenge to Singapore’s hub ambitions, as the limited size of its domestic gas market relative to the volume of LNG traded in Asia (which accounts for three quarters of global demand), makes it difficult for the country to replicate the balancing role the bigger and interconnected European hubs play in the global LNG markets.

The prospects of its storage and reload initiative may also be limited by the inefficient nature of LNG re-exports. Unlike oil, the cost of transporting and handling LNG relative to its market price is significant.

Storage costs at the Singapore LNG terminal on Jurong Island have been estimated within a range of US$2.5 million (S$3.3 million) to US$6 million British Thermal Units per year (or US$0.21 to US$0.50/MMBtu per month) depending on the source, plus unspecified reloading costs to re-export the volumes.

This means the cost of storing an LNG cargo for a year in Singapore can be as high the price of the cargo itself – the January to October 2017 average of the S&P Global Platts JKM benchmark daily spot price for physical deliveries to northeast Asia was at US$6.54/MMBtu.

Unlike oil, arbitrage decisions have to be made knowing that LNG cannot be stored for long periods because it loses volume due to boil-off.

Meanwhile, increasing flexible supplies from North America, Middle East and Asia-Pacific are reducing regional and seasonal price differentials in the global LNG markets, leading to fewer and shorter arbitrage opportunities, and less appetite for LNG reloads.

Singapore is seizing a huge part of the global LNG pie. It has reloaded six cargoes, of slightly less than 400,000 mt of LNG, from January to November 2017, up from five cargoes in 2016, according to S&P Global Platts Analytics.

Meanwhile, the global market has reloaded just over 2 million mt of LNG this year, down from a peak of nearly 6 million mt in 2014, when the JKM averaged US$13.86/MMBtu.

Storage and reload costs on a US$/MMBtu basis are even higher for medium and small-size LNG cargoes, one of the potential growth areas for Singapore.

Meanwhile, the ability of domestic end users in the potential break-bulk markets of Indonesia and the Philippines to pay a premium is particularly uncertain given downstream gas prices in those markets are heavily regulated.

Lastly, the future of Singapore’s further plans to develop the LNG sector, including LNG bunkering plans and leveraging LNG as a marine fuel – an alternative to the currently used marine diesel oil – are dependent on several factors including the areas where the vessel operates, the life of the ship, and most importantly, its relative price to other fuels.

To boost LNG bunkering in Singapore, the Maritime and Port Authority of Singapore has announced in December 2017 that it has pumped another S$12 million into the industry. The funds will be used to build new LNG bunker vessels to allow ship-to-ship LNG bunkering and to build LNG-fuelled vessels.

LNG is seen as a substitute as Asian LNG spot prices have only been marginally lower than that of marine diesel oil. In fact, LNG spot prices have risen and hit its highest since 2015, with January deliveries assessed at US$9.90/MMBtu in November according to the Platts JKM benchmark price assessment.

The long-term prospects of Singapore’s LNG hub ambitions are therefore still uncertain.

But there is room for optimism as the country is well on track to becoming a global reference for LNG trading, and a key facilitator of regional market liquidity, flexibility and transparency.

News Source: Link

Read MoreNational oil firm outlines ambitious growth plans for the next two decades

Kuwait Petroleum Corp expects to spend over $500 billion as it boosts its crude oil production capacity to 4.75 million barrels per day in 2040, the national oil firm said on Wednesday, outlining ambitious growth plans for the next two decades.

“KPC is expected to spend $114 billion in capex over the next five years and an additional $394 billion beyond that to 2040,” Chief Executive Nizar al-Adsani told an oil industry conference.

Kuwait’s current oil production capacity is around 3.15 million bpd. It revealed the plan to lift capacity to 4.75 million bpd early last year.

The figure would exceed the current output of Iraq and Iran, OPEC’s second and third biggest oil nations, whose production was 4.4 million and 3.8 million bpd respectively in December.

Iraq and Iran plan to raise output steeply in the coming years to compete with OPEC leader Saudi Arabia, which produces around 10 million bpd and has capacity of over 12 million bpd.

However, Iraq and Iraq are running far behind their targets to expand output because of infrastructure constraints, red tape and in the case of Iran, the threat of Western sanctions.

The move by Kuwait to expand capacity signals a willingness among OPEC producers to fight for market share in the long term as global oil demand rises and as the organisation faces competition from Russia and two fast-emerging oil superpowers, the United States and Brazil.

Adsani also told the conference that KPC intended to lift domestic oil refining capacity to 2.0 million bpd by 2035, while ensuring maximum offtake of domestic heavy oil production and taking into consideration the need to meet local energy demand.

KPC recently began a pre-feasibility study to lift refining capacity inside Kuwait by almost 300,000 bpd, he said without elaborating. Capacity was estimated at 936,000 bpd in 2015, according to the US Energy Information Administration.

The company intends to expand into downstream derivative and specialty petrochemical products at facilities inside and outside the country, Adsani added.

Meanwhile, non-associated natural gas production in Kuwait is to increase to 2.5 billion cubic feet per day in 2040, from 0.5 billion cfd expected in April 2018 and 1 billion cfd by 2023, Adsani said.

As part of efforts to reduce emissions of harmful gases, KPC’s future power plants will be gas-fired, although it will use renewable energy when that makes commercial sense, he added.

News Source: Link

Read MoreSINGAPORE (Feb 1): Economic confidence in Asia Pacific remained high relative to the past few years despite a dip in 4Q17 on the recent cooling of China’s economic activity, according to the Association of Chartered Certified Accountants (ACCA).

In its Global economic conditions survey final report: Q4, 2017, the global body for professional accountants attributes China’s drop in confidence to a new determination by policymakers to consider the risks of continued rapid credit growth to the broader financial system.

“We can all worry about a potential hard landing in China, but before anything like that happens, there’s a huge amount of underlying cyclical stories that are going up and down,” comments Claus Vistesen, Chief Eurozone Economist, Pantheon Macroeconomics.

“For example, we are seeing a focus away from GDP targeting to a more balanced growth trajectory. It’s a story that suggests that headline manufacturing and data could be weaker than the market expects.”

ACCA nevertheless notes that the rest of the region has continued to do very well over the latest quarter, with trade-dependent economies including Singapore all growing at, or close to, multi-year highs.

In the association’s view, all of Asia Pacific’s main subcomponents are looking reasonably stable as the government spending component appears to be firmly in positive territory, while the capital spending and employment sub-components continue to hover below zero.

ACCA particularly notes that the fortunes of these same open and trade-dependent economies – such as Singapore and Malaysia, are largely determined by the performance of the global economy – which the association believes is set to hold up reasonably well.

Andrew Kenningham, Senior International Economist, Capital Economics, is especially optimistic on the US economy for 2018.

The economist is forecasting for 2.5% inflation in 2018 and just 2% in 2019, with expectations of growth picking up to 2.2% in 2018 compared to just over 1.5% in 2017 on the anticipated fading of the squeeze on household incomes.

“In terms of the countries that matter to the global economy, particularly the US and the Eurozone, the environment looks pretty solid,” states Dario Perkins, Managing Director, Global Macro, TS Lombard.

Like ACCA, Lombard believes the outlook for 2018 remains promising.

“As an economist, you worry about debt and sustainability of growth. But as long as it’s effectively state-owned banks lending to state-owned enterprises, it’s hard to see why this would turn into some kind of debt crisis,” he says.

“So you end up with what becomes a long-term growth problem, but I don’t think that’s a story for 2018.”

News Source: Link

Read MoreDubai: Banks in the United Arab Emirates are upbeat about 2018 with faster economic growth and higher interest rates set to boost earnings.

Banks are expected to raise lending by about 4 per cent to 6 per cent this year as Dubai prepares to host the Expo 2020. Interest rate increases by the Federal Reserve, which is shadowed by Gulf central banks, will also allow banks to raise loan pricing and improve net interest margins.

“Banks should do better because quality loan demand should pick up,” said Sanyalak Manibhandu, head of research at Abu Dhabi-based FAB Securities LLC. UAE economic growth will recover after decelerating for the past three years due to higher oil prices, he said.

Full-year results for those UAE lenders that have reported have mostly beaten analyst estimates. Still, competition to win loan deals and higher provisions could weigh on earnings.

Loan growth

Economic growth is expected to accelerate to 3 per cent this year from an estimated 1.8 per cent in 2017, according to the mean estimate of 13 economists compiled by Bloomberg. The recovery in oil prices will allow the government to restart delayed projects and may persuade companies to increase investments, all of which will need financing, according to Manibhandu.

First Abu Dhabi Bank expects its loan book to grow by a mid-single digit per cent this year compared with a 1 per cent decline in 2017. Dubai’s biggest lender Emirates NBD also sees a mid-single digit percentage growth compared with a 5 per cent increase in 2017. Dubai Islamic Bank expects loans to expand between 10 per cent and 15 per cent.

Bad loans

Slower economic growth since 2014 and lower commodity prices led to a surge in loan defaults, with problem loans peaking in 2016. Still, provisions for bad loans climbed to 5.3 per cent of gross credit at the end of November, from 5.1 per cent a year earlier, according to central bank data.

Provisions at some banks could rise with the implementation of new IFS 9 accounting rules from this year where lenders have to provide for losses on loans that are expected to turn bad instead of when they actually do, according to Manibhandu at FAB Securities.

“There are no signs so far to suggest that credit quality could deteriorate in 2018,” said Shabbir Malik, a Dubai-based analyst at EFG-Hermes Holding SAE. “The macroeconomic environment is largely favourable and some of the stresses that we have seen in small and medium enterprise and retail loans have already peaked or started to come down.”

Net interest margins

Most UAE banks expect stable or better net interest margins — the difference between what banks earn on assets and pay on liabilities and customer deposits — this year amid three projected interest rate hikes in the US. Still, some of these gains on margins could be squeezed as banks lower pricing on loans for borrowers to win deals, according to Malik at EFG-Hermes.

Emirates NBD sees its net interest margin to improving to between 2.55 per cent and 2.65 per cent, up from 2.47 per cent in 2017. Dubai Islamic Bank projects that its will stabilise between 3 per cent and 3.15 per cent, compared with 3.11 per cent last year.

News Source: Link

Read MoreMalaysia’s national oil company Petronas saw an increase in profit during the second quarter 2017 helped by higher prices across all products and cost cuts.

Petronas’ profit after tax for the quarter was RM 7 billion compared to RM 1.7 billion in 2Q of 2016, a significant improvement mainly due to lower net impairment on assets and well costs, coupled with higher average realized prices recorded across all products.

This was partially offset by higher net foreign exchange losses, amortization of oil and gas properties and non-FID costs for PNW LNG in Canada, the company said.

The profit was posted on the back of a RM 51.6 billion revenue, a 10 percent increase from RM 46.9 billion from the corresponding quarter last year as a result of higher average realized prices and foreign exchange rate impact.

However, the company said, despite higher prices compared to a year ago, the industry remains volatile tempering the company’s optimism.

Datuk Wan Zulkiflee Wan Ariffin, President and Group CEO Petronas, said: “We have closed out the first half of the year with stronger financials compared to the same period in 2016. While the price of oil was a significant factor, I also view this as tangible results of Petronas’ transformation measures taken in response to the industry downturn.”

Crude oil, condensate and natural gas entitlement volume for the second quarter of 2017 was 1,706 thousand barrels of oil equivalent (boe) per day compared to 1,648 thousand boe per day. The increase was in line with higher gas production. Total production volume was 2,297 thousand boe per day compared to 2.329 thousand boe per day in the corresponding quarter last year.

News Source: Link

Read MorePETALING JAYA: Oil and gas (O&G) counters have gained much attention of late following the rise in oil prices.

Since the new year began, O&G stocks that operate in the upstream services segment such as UMW Oil & Gas Corp Bhd (UMW-OG), Sapura Energy Bhd

image: https://cdn.thestar.com.my/Themes/img/chart.png

and Bumi Armada Bhd

and Bumi Armada Bhd

image: https://cdn.thestar.com.my/Themes/img/chart.png

have seen impressive gains of as much as 55% in just two weeks.

have seen impressive gains of as much as 55% in just two weeks.

But some counters had retraced at least half of their gains by the end of last week.

Notably, they reminded that upstream O&G service players would be the biggest beneficiaries should capital spending return. However, there is no hint of the former happening just yet.

“I believe the rise and then retracement of these stocks signal that confidence has yet to fully return to the wider industry. There is still a concern that these players might not benefit immediately. The signal will come when Petronas decides that it is time to increase capital expenditure (capex) significantly again,” an analyst said.

While there was a retracement that was seen in O&G stocks, Brent crude oil has continued rising almost 4% since the new year to a high of US$69.26 per barrel and had sustained most of these gains until Friday.

“It is not business as usual like before and the recent price action (in O&G stocks) may be moving ahead of themselves, and investors may wonder why some of these counters still have not turned around or meaningfully seen a change in their fortunes,” he added.

On whether upstream activities have significantly returned to the scene, offshore services provider Alam Maritim Resources Bhd

image: https://cdn.thestar.com.my/Themes/img/chart.png

’s managing director Datuk Azmi Ahmad told StarBiz that there has yet to be an improvement in daily charter rates.

’s managing director Datuk Azmi Ahmad told StarBiz that there has yet to be an improvement in daily charter rates.

“There is an increase in the activities in the marine support sector, which has improved the vessel utilisation rate. However, we have yet to see an improvement in the daily charter rate. We hope 2018 will be a better year for marine support services,” Azmi said.

“Oil majors have increased their requirements on marine vessels mostly through spot charters. The Pan Malaysia contracts are ongoing now and we hope to see the award of contracts in the first quarter of 2018,” he added.

StarBiz had reported in December that Petronas’ spending requirements for upstream assets such as rigs would be halved from three years ago.

The report noted that the need for jack-up rigs, which are used in exploration activities, has been reduced by half to about 10 rigs for the period 2018-2020, compared to the 2013-2014 period.

For local players, AmInvestment Bank Research said in a sector report recently that scope of works for these O&G service players is mainly determined on a call-up basis.

The research house expects Petronas to maintain its cautious tone on upstream exploration and development expenditures, noting that the worst might not really be over yet.

“For Pan Malaysia operators which operate wholly offshore, these weak capex rollout prospects forebode that the worst can stretch on for quite a while for those struggling with high gearing such as Bumi Armada Bhd, Alam Maritim and UMW-OG,” it said, maintaining its neutral call on the industry.

AmInvestment said it may upgrade the sector if the visibility improves for a faster pace of upstream capex rollouts, which would ultimately hinge on whether the higher crude oil price is sustainable.

It also did not discount the possibility of oil prices falling once again.

O&G companies have continued to see their share prices see-sawing, and in retrospect investors might have incorrectly timed their rise.

A recent case in point in relation to this phenomenon was seen at Sapura Energy.

Despite some buying action seen in its shares in the first half of 2017, its shares gave up all of those gains during the second half of last year despite a continued recovery in oil prices.

Last month, Sapura Energy shocked the market when it announced a net loss of RM274.41mil for its third quarter.

It attributed the losses to lower contributions from its engineering and construction and drilling segments, including the lesser share of profit from its joint ventures.

Sapura Energy’s shares plunged some 20% when the results were announced and fell a total of 45% for the remainder of the year until the new year where it gained traction once again.

Meanwhile, Hong Leong Investment Bank (HLIB) Research said in its report on Friday that it had raised its Brent oil price target for 2018 to US$55-US$65 per barrel, given rising geopolitical tensions that may cause sudden supply shortages which could disrupt the current balanced market.

It has retained its neutral rating on the sector as a whole, noting that while O&G companies’ earnings under coverage are believed to have bottomed in 2017, earnings recovery overall in 2018 is still not sufficient to justify a rerating on the sector as a whole.

“We elect to await clearer signs of recovery to warrant more upgrade in the sector,” HLIB Research said.

News Source: Link

Read More