Augmented reality and virtual reality technology is expanding beyond gaming and beyond chasing and catching Pokemon. Now, it’s hit the oil industry and aims to save it money.

The oil and gas industry has started using AR to fix and maintain equipment at oil and gas facilities, cutting downtime and costs and saving on travel expenses for flying specialized staff thousands of miles to the actual facilities.

AR headsets with smart goggles provide on-site technicians with wireless connection directly to headquarters staff or to the most skilled experts thousands of miles away, who can guide the on-site staff through the tasks they perform via audio and video.

Analysts expect technological advances to play an increasingly important part in the continued cost cuts for oil—an industry that has already slashed costs across the board to survive and reposition itself to profit at low oil prices.

The AR revenue for the energy and utilities sector will be a US$18-billion market in 2022, with platform and licensing, as well as smart glasses hardware, comprising the majority of that market, according to ABI Research.

This year alone, the energy and utilities industries will account for 17 percent of global smart glasses shipments, the advisory firm said.

“AR enables better visualization of underground assets, pipelines in concrete, or complex components, which help avoid breaks while digging, detect dangerous leaks, and reduce accidents. Accordingly, employee safety will be maintained along with a decline in errors and total downtime,” Marina Lu, Senior Analyst at ABI Research, says.

For an oil industry recovering from the oil price crash, cutting downtime and costs and boosting efficiency is the new normal at oil prices half their level compared to 2014.

So, companies have jumped on the ‘digital disruption’ bandwagon and some are already using smart goggles and wearables to reduce downtime and increase safety.

For example, Baker Hughes, now part of GE, has been using the Smart Helmet developed by Italian company VRMedia Srl.

Recently, Baker Hughes has replaced parts of a turbine at a petrochemical plant in Malaysia in five days and no travel expenses as one on-site technician was guided by specialized U.S. engineers supervising the work remotely from a Baker Hughes site in California. The replacement of the parts would have otherwise involved at least 10 days of halted operations at the plant and US$50,000 to fly the American team, Bloomberg reports.

Cutting the downtime saves millions of dollars to oil companies.

According to Deloitte, a 100,000-bpd refinery losing a single day of operations could reduce revenues by more than US$5.5 million and cut profit by US$1.4 million.

Oil and gas facilities shut for 27 days each year on average, Bloomberg quoted industry analyst Kimberlite International Oilfield Research as saying.

Remote AR is not the cure-all wonder tech because it needs reliable wireless networks which oil rigs in the wilderness often lack, and because headsets need to meet strict safety standards to be used close to hazardous materials.

But some of the biggest oil firms are already using some kind of AR or VR or wearables to increase safety and efficiency and cut costs.

Eni and MIT have created wearables to improve workplace safety in the oil and gas industry.

Shell is using VR in training for safety training procedures at a deepwater oil project offshore Malaysia.

BP uses AR smart glasses in its U.S. operations, alongside drones and advanced analytics.

Scotland-based Cyberhawk performs inspections and surveys with drones at oil and gas platforms, plants, and refineries across the world, and its clients include major oil and gas companies.

The use of sophisticated and smart technologies is spreading across the oil sector, in which the biggest firms and all those smaller companies who survived the downturn continue to look to save more costs.

News source: Link

Read MoreSINGAPORE (Mar 27): Singapore’s central bank is expected to tighten monetary policy in April for the first time in six years, with economic growth solid and the labour market showing signs of improvement, a Reuters poll of economists found.

Nine of 15 analysts said their baseline expectation is for the Monetary Authority of Singapore to tighten its exchange-rate based policy at its semiannual policy decision, expected to be announced in mid-April.

The poll was conducted between March 21 to March 27, and was based on direct responses to Reuters queries as well as some research notes.

The nine analysts expect the MAS to tighten policy by slightly increasing the appreciation rate of the Singapore dollar’s policy band, which is currently at zero percent.

“We forecast a continued broadening of growth and gradual reduction in labour market slack, underpinning a moderate rise in core prices. This dynamic should guide policy toward a modest tightening stance next month,” Benjamin Shatil, an economist for JPMorgan, said in a research note.

The remaining six analysts predicted that the central bank would keep policy on hold in April.

The central bank has kept the appreciation rate of the Singapore dollar’s policy band at zero percent since April 2016, in what the central bank refers to as a “neutral” policy stance.

If the MAS tightens policy next month, it would mark the central bank’s first policy tightening since April 2012, when it increased the slope of the band slightly.

The MAS manages monetary policy by changes to the exchange rate, rather than interest rates, letting the Singapore dollar rise or fall against the currencies of its main trading partners within an undisclosed policy band based on its nominal effective exchange rate (NEER).

It can adjust policy by changing the appreciation rate, mid-point, or width of the Singapore dollar’s policy band.

At its last policy review in October, the MAS changed a reference to maintaining its neutral policy stance for an extended period, a shift that analysts said created room for the central bank to tighten policy in 2018.

Read MoreChinese state-owned oil and gas giant PetroChina is planning to replace its oil-linked long-term LNG contracts with shorter, more flexible deals, a senior company official said late last week as it announced is 2017 financial results.

PetroChina Vice Chairman and President Wang Dongjin said that existing oil-linked long-term contracts from Qatargas, Yamal and Gorgon, will not be renewed. S&P Global Platts Analyticssaid that contracts for a combined total of 14 million tons per annum (mtpa) will expire over the 2025-2038 period.

Last year, China became the world’s second largest LNG importer, after Japan, effectively bypassing South Korea. China’s increased gas usage comes as Beijing ramps up its goal of replacing coal with cleaner burning natural gas for electrical power generation and also industrial usage. The government mandates that at least 10 percent of the fuel used to meet energy demand be comprised of natural gas, with further earmarks set for 2030.

Chinese LNG imports averaged 5 billion cubic feet per day (Bcf/d) in 2017, exceeded only by Japanese imports of 11 Bcf/d. Imports of LNG by China, driven by government policies designed to reduce air pollution, increased by 1.6 Bcf/d (46 percent) in 2017, with monthly imports reaching 7.8 Bcf/d in December, according to a February 23 U.S. Energy Information Administration (EIA) report.

In the long term, China’s share of global LNG demand is expected to converge with that of Japan, S&P Global Platts Analytics added. China’s requirements are also growing, as its contracted obligations rise much more slowly than its demand projections, meaning Chinese importers will play an increasing role in global LNG market fundamentals and prices.

Currently, China has 17 LNG import terminals at 14 ports along its coastline, with a combined regasification capacity of 7.4 Bcf/d, according to the EIA.

Unstoppable LNG market shifts

PetroChina’s move is yet another sign that global LNG markets are still undergoing profound fundamental shifts, albeit being revolutionized amid a historic supply overhang of the super cooled fuel.

Moreover, expect even more changes to unfold as extra supply hits the market from Australia, which will soon have as many as ten major LNG export projects operational, bypassing Qatar either later this year or next year to become the largest LNG producer in the world.

By the end of the decade, the U.S. will become the world’s third largest LNG producer when it will have five major LNG export projects operational, with that number to increase substantially in the mid-2020’s as a so-called second wave of U.S.-LNG export project development kicks in.

In essence, despite what producers claim (including Qatar, which will ramp up LNG production from 77 mpta to 100 mtpa within the next five years), markets will reach equilibrium and even enter a period of undersupply after 2022 or soon thereafter, there seems to be no turning back to the old model when LNG buyers were at the mercy of producers and restrictive long term 20 and even 30-year off-take agreements. Going forward, LNG will increasingly trade more like a true liquid commodity, similar to iron ore and even crude oil.

Also, on Thursday PetroChina reported 4.8 billion yuan (US$766.9 million) in net profit in the fourth quarter of 2017, the worst quarterly result last year and down from 6.7 billion yuan in the third quarter. However, total revenue rose to 558 billion yuan in the three-month period, compared with 482 billion yuan in the previous quarter.

Huang Lili, an analyst with CITIC Securities, attributed the lower earnings to losses due to LNG imports in the fourth quarter when China suffered massive gas shortages.

These supply shortfalls came in large part due to Beijing’s rapid and arguably premature push to replace more coal usage with natural gas, just as harsh winter temperatures set in. China’s increased winter gas usage sent LNG spot prices in Asia to three years highs, breaching the $11/MMBtu mark at the end of last year. Since then, however, prices have trended downward as warmer temperatures set in. In trading last week, spot prices for May delivery LNG-AS slipped to about $7.10/ MMBtu, 60 cents below levels from the previous week, said several trade sources surveyed by Reuters.

News source: Link

Read More- Equity indexes in South Korea, Japan climb: yen steady

- Traders await private report on Chinese purchasing managers

Asian shares edged higher, the dollar steadied and Treasuries slipped as the second quarter began for some of the region’s traders. Volumes are expected to be subdued with many markets across the world still closed for the Easter holiday.

Equities in Japan and South Korea climbed, while U.S. index futures showed small declines. The yen was steady as traders digested a poll showing improved support for Prime Minister Shinzo Abe’s cabinet. Chinese stock futures were little changed ahead of a private survey of purchasing managers. The won rose to its strongest against the dollar in over three years as tensions in the region showed further signs of easing. West Texas crude oil climbed past $65 per barrel.

Investor focus this week turns to U.S. labor market data Friday with unemployment expected to fall to its lowest since 2000. Traders are also awaiting details on U.S. plans for tariffs on China, amid concerns about an escalation in trade tensions that could disrupt global supply chains and hurt the outlook for corporate earnings.

Over the weekend an official gauge of activity at China’s manufacturers posted its first gain since November as factories recovered from a seasonal dip at the start of the year and export demand shrugged off threats of a trade war.

Elsewhere, Bitcoin remained below $7,000.

Here are some key events coming up this week:

- Easter Monday is a public holiday in many areas including the U.K., Australia, Canada, and most of Europe.

- U.S. manufacturing PMI and ISM manufacturing data due Monday.

- Reserve Bank of Australia April monetary policy decision due Tuesday.

- New York Fed debuts the Secured Overnight Financing Rate on Tuesday.

- Reserve Bank of India April policy decision due Thursday.

- U.S. employment data due Friday; jobless rate probably fell in March after holding at 4.1 percent for five straight months.

These are the main moves in markets:

Stocks

- Japan’s Topix index rose 0.2 percent as of 9:16 a.m. in Tokyo.

- South Korea’s Kospi added 0.8 percent.

- Futures on the S&P 500 slid 0.1 percent.

- The MSCI All Country World Index was down 1.4 percent for the first quarter, the first losing one since the start of 2016.

Currencies

- The Bloomberg Dollar Spot Index fell 0.1 percent.

- The Japanese yen was steady at 106.28 per dollar.

- The euro was little changed at $1.2318.

Bonds

- The yield on 10-year Treasuries rose two basis points to 2.76 percent.

Commodities

- West Texas Intermediate crude rose 0.4 percent to $65.17 per barrel.

- Gold was flat at $1,325.50 an ounce.

News source: Link

Read MoreSINGAPORE (Mar 21): Business confidence in Singapore dipped over the first quarter of 2018 even as the region’s business sentiment reached a seven-year high, according to the Thomson Reuters/Insead Asian Business Sentiment Survey for the first quarter.

During the Jan-Mar period, Singapore’s sub-index declined to 75 from 79 due to Feb’s surprise dip in exports as tech product shipments continued to retreat from the hot pace of recent months.

The Thomson Reuters/Insead Asian Business Sentiment represents the six-month outlook of 67 firms in Asia. A reading above 50 indicates a positive outlook.

The overall index for the whole Asian region advanced a notch to 79 from 78 three months ago, driven by robust jumps in sentiment from Thailand, the Philippines and Malaysia, which Reuters attributes to the benefits enjoyed by Asia from accelerating growth.

China’s soaring exports, in particular, has driven the country’s index significantly up to 88 from 83 in 1Q18 in spite of US President Donald Trump’s intent to announce additional import tariffs targeted specifically at China.

Conversely, South Korean sentiment appears to have been battered by Trump’s threats of scrapping the US free-trade deal with the country, resulting in the plunging of South Korea’s subindex to 50 from 83.

Amid an environment of subdued consumer spending, Japan recorded its lowest reading in a year at 67 from 70 in 4Q17.

Sector-wise, retail & leisure, healthcare and the auto sectors hit record-high readings in the index, although concerns over trade friction and rising interest rates remained.

“The improvement [in overall Asian business sentiment] is not dramatic but with a historical perspective this is a good reading,” Antonio Fatas, a Singapore-based economics professor at Insead was quoted saying by Reuters.

On China’s higher sub-index score this quarter, he explains: “China… has escaped the fear of a crisis that started back in 2016 and that’s why you see strong confidence. Imbalances persist but there is no real threat of a crisis over the short term.”

News source: Link

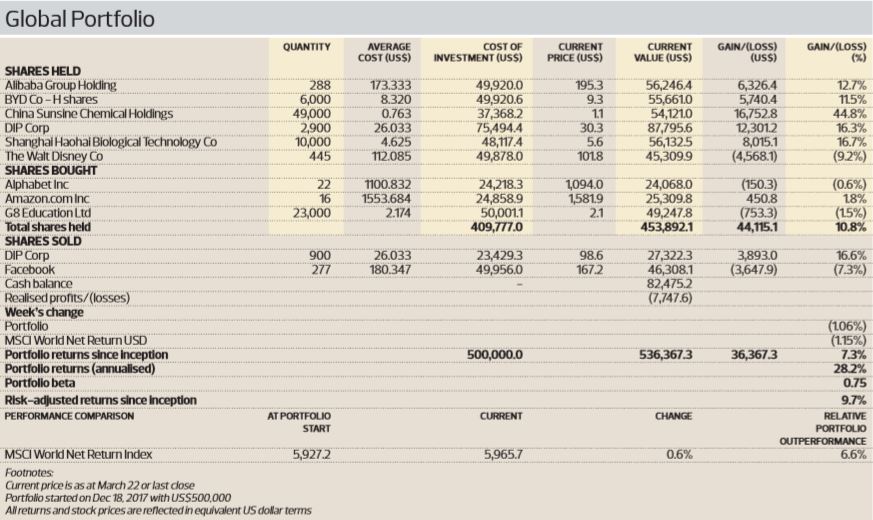

Read MoreI made a big investment in DIP, double the typical amount I would invest per stock and it has paid off. Its shares have performed well, rising as high as ¥3,550 just prior to the global market selldown. Therefore, I have decided to gradually normalise my investment in the stock and also to lock in some profits.

The company reported a good set of earnings results for the latest quarter ended November 2017. Earnings before interest, taxes, depreciation and amortisation (Ebitda) for the quarter were up an outsized 27% y-o-y compared with the 14% revenue growth on the back of improving margins.

In fact, this underlines the basis for my upbeat outlook for tech companies — the benefits of the network effect, limited supply constraints for those with digital-focused businesses and long-term marginal cost that approaches zero.

What could upset this apple cart? Regulatory challenges.

Government scrutiny in the US and EU — especially as it pertains to the collection and protection of a vast trove of personal information — has been on the rise, but never more intense as the investigation into Russian meddling in the 2016 US presidential election unfolds.

In particular, lawmakers are examining the role of social media platforms in the dissemination of fake news and, this week, the revelation of how a British-based data analytics company misused the personal data of up to 50 million Facebook users to influence the election.

Facebook is at the forefront of this regulatory backlash — and may well be the first to feel the real impact of any legislative fallout. The stock was heavily sold down after news of the data misuse came to light. I believe this selldown is justified. The impact of the resulting regulations will have a significant impact on Facebook’s revenue and profits.

For those of you who remember, it was the US government that forced the break-up of AT&T (affectionately known as Ma Bell) in 1984, then the world’s largest telco monopoly. It, too, was benefiting from the network effect and appeared then to be in an insurmountable position.

I bought Facebook shares because they offered the best value and the company has the best business model among the big tech companies. Revenue growth is strong and margins are holding up. Marginal costs are minimal, unlike for Amazon.com and Alphabet, which are spending heavily on new investments, including physical assets that will drive down returns on equity.

All these are still true. But given the rising regulatory and legal risks, I have decided to cut my losses. Nevertheless, I still believe that tech companies are reasonably valued relative to their prospective growth. Hence, I am reinvesting proceeds from the sale of Facebook into shares in Amazon and Alphabet, both of which are household names that require little introduction.

Amazon is the largest e-commerce player in the US, though most of its profits currently come from the cloud computing business. The company is also investing big in physical stores, warehouses and distribution logistics. I think their biggest promise is in creating a new home ecosystem. I will explain more on this in the future.

Alphabet, meanwhile, derives most of its revenue and earnings from advertising. It has numerous platforms with a huge user base, including YouTube, Gmail, Google Maps, Chrome and Android, plus big side bets on AI and autonomous cars.

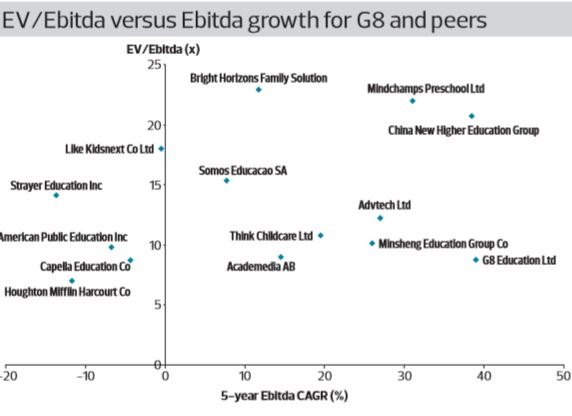

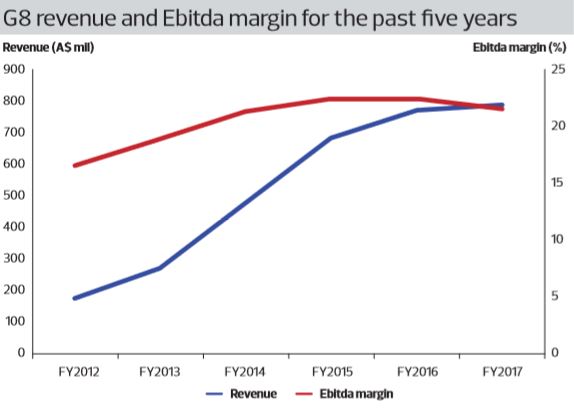

I also acquired about US$50,000 ($65,623) worth of shares in G8 Education, which is listed on the Australian Securities Exchange and is the country’s second-largest operator of day care and education centres for children aged below five. Most of its 495 centres are located in New South Wales and Victoria, with another 21 in Singapore.

G8 has grown its Ebitda at an impressive annual pace of 37% up until 2017 on improving margins. Last year, growth stalled, owing to increased competition, and its share price fell sharply in response.

I believe G8’s outlook will improve this year, underpinned by mature contributions from the 58 centres acquired in 2016 and 2017. The company also undertook refurbishment and improvement works at many of its centres last year as well as staff upskilling to meet more stringent regulatory requirements. G8 benefits from economies of scale, including from procurement, staff training and placements.

In addition, the government’s new Child Care Subsidy (that will come into effect in July 2018) will raise subsidies for low-middle income families, which should in turn boost demand for childcare services.

The company generates positive free cash flow and distributes 75% of its annual profits as dividends. At current prices, that will give shareholders an estimated yield of over 6%. Its shares are trading at only nine times trailing EV/Ebitda and 15 times price-to-earnings ratio (see Charts 1 and 2).

After taking into account all the above transactions, cash in the Global Portfolio was reduced to about 16% of total portfolio value. The Global Portfolio is now up 7.3% since inception and continues to outperform the benchmark index, which is up 0.6% over the same period.

Meanwhile, I continued to reduce my exposure for the Malaysian Portfolio. My cash holdings have now increased to RM91,477 ($30,722), or about 28% of total portfolio value.

As I have said previously, my recent disposals were driven by macro considerations and not stock-specific ones. The aim is to be prudent and raise some cash that will give us more room to manoeuvre once the global markets stabilise.

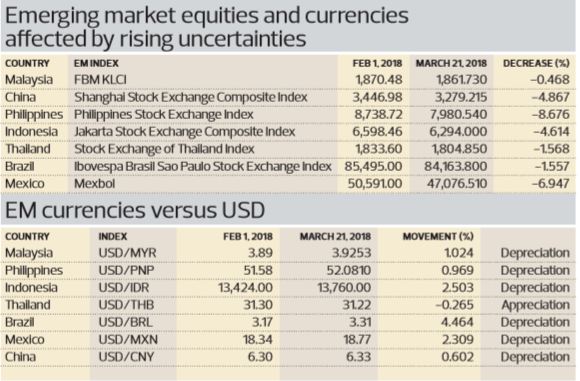

Table 1 shows select emerging market index and currency movements since the global selloff. Notably, countries such as the Philippines, Indonesia, China and Mexico have suffered more than their fair share of pain in the equity selloff, while most emerging market currencies too have depreciated against the US dollar over this period.

Increased market volatility usually results in investors turning more risk-averse and pulling money out of perceived riskier emerging markets. In addition, many emerging economies are still heavily dependent on exports and are therefore weighed down by rising concerns of a brewing trade war.

Tong Kooi Ong is chairman of The Edge Media Group, which owns The Edge Singapore

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks, including the particular stocks mentioned herein. It does not take into account an individual investor’s particular financial situation, investment objectives, investment horizon, risk profile and/or risk preference. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.

This article appeared in Issue 823 (Mar 26) of The Edge Singapore.

Source: Link

Read MoreWill utilising it prove to be boon or bane?

When the word blockchain is mentioned, thoughts of Bitcoin cryptocurrency naturally arise, but not for energy experts in Southeast Asia who have started to view the technology as an answer to the region’s escalating energy challenges.

The ten-member Association of Southeast Asian Nations, or ASEAN region, faces an “energy conundrum,” said Beni Suryadi, manager, policy research & analytics at ACE, with hundreds of millions in the block living without grid-quality electricity.

Energy demand in ASEAN is continuously rising given fast-growing populations and rapidly expanding industrial development. Suryadi expects the bloc’s energy demand to rise almost 4% for the next two decades, higher than the 1% global average.

The ASEAN energy mix is also predominantly made up of fossil fuels, complicating the path towards the goals governments have set to pursue cleaner energy options and meeting global climate agreements.

Given ASEAN’s unique energy profile, energy digitalisation has emerged in the radar of experts as a source for novel solutions. Blockchain in particular checks most of the boxes in Malaysia’s search for a solution fitting its future energy roadmap, said Dr. Wei-nee Chen, chief corporate officer at SEDA Malaysia, the government agency which spearheads the country’s energy transition by implementing net metering schemes and other energy efficiency programs.

Chen said Malaysia’s vision of the future of energy can be summed up in 6D’s, namely decentralised, distributed, decarbonised, democratised, deregulated, and digitised. Of these, blockchain technology adopts five, only missing the decarbonisation component.

One of the most popular uses of blockchain in the energy sector is in powering a peer-to-peer energy market, according to Chen. It is also used in managing localized demand response in a more cost effective manner. Finally, blockchain enables the sale of electricity through location-based pricing, which could result in driving down customer electricity costs as they can purchase directly from the supplier and avoid heavy grid costs.

Chen acknowledged that the use of blockchain technology anywhere around the world is still in the infancy stage, but she noted that at the end of 2017, Malyasian Prime Minister Najib Razak announced the formation of a national regulatory sandbox, which allows innovative technologies to be tested in a live environment without the regulatory constraints. The sandbox was set for a trial period of nine months after which the sandbox participants will propose regulatory changes so their innovations can run in live environments.

SEDA has submitted an application to allow the agency to test a peer-to-peer energy platform, to allow solar producers to sell their excess electricity to consumers even at a lower rate than what the distribution system operator is willing to buy.

“So all these exercises… are meant to promote the solar PV market domestically by hopefully designing a business model that makes the investment in the PV systems more commercially viable,” said Chen.

Blockchain technology is also paving the path towards conceptual models for the faster adoption of renewable energy, a target for many ASEAN countries as they seek to boost their energy security and power their growing economies.

“If we look at the energy system as a series of distributed markets then there’s the opportunity to move toward a completely renewable energy system far more quickly,” said David Martin, managing director at PowerLedger.

“The ability to create renewable distributed microgrids allows consumers who currently do not have access to energy supplies to get access to clean green, and importantly, low-cost energy,” he added.

Martin said relying on large, expensive transmission and distribution systems makes the supply of energy more expensive, while using distributed microgrids can do away with those costs.

“The solution is really looking at the energy system now rather than as a large, single system as a series of interconnected and dynamic microgrids” with the customer at the center, said Martin.

“The solution itself is the development of a trading platform but the tool that provides that platform is the blockchain,” since it “provides an immutable record of energy transactions and can be used to provide a trustless environment,” he added.

News source: Link

Read MoreIn general, an API refers to a technical specification for operating a specific program by another program, and it defines command statements (commands and functions) used when the program is operated, a format of data to be transmitted and received, and the like. For example, many businesses today display a Google map when publishing their location on the website. This is realized by outputting map data (Google Maps) using Google’s API (Google Maps API).

The origin of the API exists in the software industry, especially in an enterprise application integration (a method of building and controlling company-wide business systems). It was once a manner of system development for excellent software engineers. Today, the open API has become a business policy of outstanding business managers. In 2002, Jeff Bezos issued a mandate to all his internal development teams regarding how software was to be built at Amazon. All teams will henceforth expose their data and functionality through service interfaces; teams must communicate with each other through these interfaces; there will be no other form of inter-process communication allowed; it doesn’t matter what technology you use; all service interfaces, without exception, must be designed from the ground up to be externalize-able.

Fifteen years after this declaration, an open API tsunami has spread to even the most conservative industry, financial services. In May 2017, the Japanese financial industry steered to a new framework. The Amended Banking Act decided to introduce a registration system for Electronic Settlement Agency Service Providers, so-called “Third Party Providers (TPPs)” and to announce policies of collaboration between banks and TPPs. Measures concerning the promotion of open innovation at banks eventually emerged as new regulations. This turned out to be a major shift in Japan’s financial regulations.

When financial institutions disclose APIs to TPPs, the biggest system risks would be data leakage/ tampering, illegal transactions, etc. API is a new communication path of information systems but it could be misused. There is also a possibility that data included in the user’s account information and settlement instructions will be exposed to the risk of leakage/tampering via TPPs. In response to this risk, various discussions emerged from the viewpoint of financial institutions/ TPPs/ users regarding risk types and convenience with respect to the service form of TPPs and the data transmission/ reception method, which have been mainstream in Japan so far. The outcome of the discussions was the shift from Legacy Authentication: scraping method to open API: token authentication. Legacy Certification: scraping method will no longer be accepted in the Japanese market in the future.

Token authentication means that after a financial institution authenticates a user, it generates data (token) indicating the range of data to be accessed to the TPPs and the range of available services, transmits the data to the TPPs, and uses it. It is a method of sending and receiving data between TPPs and financial institutions. Compared to legacy certification, the burden of information system upgrading, etc. to implement is generated at the financial institution side. For users, however, registration of ID and password to TPPs becomes unnecessary, and data range accessible by TPPs can be controlled. The Japanese financial industry will now begin to thoroughly enforce these access rules based on Token Authentication as industry rules.

In parallel with the discussions about systematic means of implementing such access methods and authentication methods, Japanese banks have pursued profit from open APIs in various ways. Until now, they have provided API release and collaboration for specific business operators (PFM/ Cloud accounting services/ ERP), mainly focusing on hackathon and accelerator programs (α program: idea contest, β program: a joint project with specified businesses, investment). In the future, the new strategy will dominate, where the banks will develop the community (3rd party developed application store, the operation of open API platform for developers, application platform delivery). Under some frameworks, not only will open APIs be new revenue opportunities for financial institutions as B2B products, but API platforms will likely evolve into a platform for innovation, encouraging financial reform in financial institutions.

Since they first began employing computers in the 1960s, Japanese banks have always limited themselves to closed and rigid approaches to system development. Today there are cracks appearing in those rigid foundations that have underpinned system development for more than half a century. If existing conventional banks stubbornly adhere to their analog approach, digital customers can be expected to flee to emerging financial service offerings that better cater to their needs, presumably precipitating the demise of these traditional banks. This shift will progress gradually at the very beginning and then at an accelerated pace.

The open API will be a powerful trigger for the value chain revolution sure to take place in the Japanese banks and financial services industry.

BY EIICHIRO YANAGAWA. The views expressed in this column are the author’s own and do not necessarily reflect this publication’s view, and this article is not edited by Asian Banking & Finance. The author was not remunerated for this article.

Source: Link

Tribune News Network, Doha — Qatar Petroleum (QP) has selected Chiyoda Corporation of Japan to execute the Front End Engineering and Design (FEED) of the onshore facilities of the North Field Expansion, an official statement said on Monday.

The facilities will produce an additional 23 million tonnes per annum (mtpa) of LNG, which will raise Qatar’s production from 77 to 100 mtpa, as announced by Qatar Petroleum last July.

“The award of the Front End Engineering and Design contract to Chiyoda Corporation is a significant milestone in our journey to deliver the first LNG from this new project by the end of 2023,” QP President & CEO Saad Sherida al Kaabi said.

The addition of 23 mtpa of LNG will not just enhance Qatar Petroleum’s position as the world’s largest LNG producer and exporter, but also its international image as a reliable and trustworthy energy provider, he added.

“The expansion of Qatar’s LNG production from the North Field is an important landmark in Qatar Petroleum’s strategic growth plan and objectives of becoming one of the best national oil and gas companies in the world.

“We are continuing discussions with potential international joint venture partners for this strategic project to determine an optimised arrangement with the objective of delivering maximum value to Qatar and contribute to the optimal utilisation of Qatar’s natural resources.”

News source: Link

Read MoreThe banks make up the Thailand Blockchain Community Initiative.

Bank of Thailand, the country’s central bank, announced that 14 Thai banks have joined forces to create the Thailand Blockchain Community Initiative and use blockchain technology in developing a shared trade finance platform.

Thailand’s big four—Bangkok Bank, Krung Thai Bank, Siam Commercial Bank, and Kasikornbank—are participating in the initiative which will be tested in the central bank’s sandbox and will be online by September. It will be used to issue digitised Letters of Guaranee and documents, and shorten processes.

“With this infrastructure sharing, banks do not need to invest on their own. Interoperability enhances efficiency, reduces costs in our financial sector and addresses the needs of the consumer and the business sector,” Veerathai Santiprabhob, the governor of the Bank of Thailand, said at a press conference.

The initiative utilises Linux Foundation’s Hyperledger Fabric as a technology platform.

News source: Link

Read More