The Straits Times/2 November 2017

SINGAPORE – HIGHER finance costs and lower revenue eroded third-quarter earnings for Sembcorp Industries, which also wrote down $56.3 million on its utilities business in Singapore.

Net profit for the group tumbled 37.7 per cent to $33.6 million from the previous year.

This translates to earnings per share of 1.23 cents, down from 2.47 cents in the same period a year ago.

This was, however, nearly all erased by an increase of $36.1 million in finance costs. These were due to SembMarine’s higher bank borrowings and finance costs for Sembcorp’s newest thermal power plant in India, Sembcorp Gayatri Power.

Sembcorp made an impairment of $25.8 million as it wrote off the steam boilers in the Sakra area on Jurong Island which had been built in the late 1990s. The group plans to use an upcoming waste-to-energy plant on Jurong Island to produce steam more efficiently instead.

It also impaired $26.4 million on the goodwill value for Sembcorp Cogen that was acquired in 2003, as the cogeneration plant has been making losses over a period of time, said chief financial officer Koh Chiap Khiong at a briefing.

Another $4.2 million in impairment was made in relation to the utilities division’s investment in an associated company.

At the briefing, chief executive Neil McGregor also told analysts and reporters that it has signed an agreement to sell utilities assets that were previously serving Jurong Aromatics Corporation (JAC) to ExxonMobil Asia Pacific.

ExxonMobil had acquired JAC’s plant earlier this year.

The boilers, cooling tower and associated assets will be sold for US$113 million, he said. The deal will be completed between the second half of 2019 and first half of 2020.

Shares in Sembcorp fell two cents, or 0.6 per cent, to $3.38 before the results were announced.

Correction note: Sembcorp has clarified that the steam boilers which are impaired are not part of its power plant. An earlier version also stated that the deal with ExxonMobil will be completed between the second half of 2019 and first half of 2010. This is incorrect. It should be first half of 2020. We are sorry for the error.

The Straits Times/1 November 2017

SINGAPORE – Small- and medium-sized logistics businesses will find opportunities to take part in projects that could benefit the entire industry through a newly revealed Industry Digital Plan (IDP), the Infocomm Media Development Authority (IMDA) said on Wednesday (Nov 1).

The online plan will guide logistics SMEs towards participating in projects and national initiatives that aim to “uplift the whole sector”. These include in-mall distribution, federated lockers and the National Trade Platform, IMDA said.

Logistics SMEs will receive step-by-step advice on the digital solutions required at each stage of their business growth in the digital economy. A new self-assessment checklist will also be made available on SME Portal to help SMEs identify their digital readiness and the digitalisation opportunities based on their needs.

IMDA will also continue to put up digital solutions it has pre-approved – such as in customer management or data analytics – on Tech Depot, a one-stop platform for tech solutions on the SME Portal website.

Among the first projects that will be highlighted under the IDP is a tripartite partnership between IMDA and VCargo Cloud, together with Bollore Logistics (Singapore), Dimerco Express Singapore and LCH Lockton, to make use of digital technology to improve efficiency.

IMDA said: “As major logistics players, these companies will lead their SME clients through the digitalisation process using VCargo Cloud’s Cargo Consolidation Platform, which will help SME freight forwarders or shippers to lower freight rates and develop internal capabilities and efficiencies.”

The TechSkills Accelerator (TeSA) programme – a SkillsFuture initiative launched in April 2016 to train information communications technologies professionals – will support the IDP.

IMDA, with support from the Singapore Economic Development Board and Spring Singapore, launched the Logistics IDP as part of the SMEs Go Digital Programme, and in support of the Logistics Industry Transformation Map.

News Source: The Straits Times

Read MoreReuters/25 October 2017

TOKYO (Reuters) – Toyota Motor Corp said its solid-state battery technology under development could be a “game changer” for electric vehicles, but that does not mean it is moving away from hydrogen-powered fuel-cell vehicles.

Having long touted fuel-cell vehicles and plug-in hybrids as the most sensible technologies to make cars greener, Japan’s top-selling automaker surprised industry watchers last year with plans to add full-sized electric vehicles (EVs) to its line-up.

In doing so, it joins a rush of global automakers scrambling to develop more EVs, in large part due to China’s push to promote the technology as a way to reduce pollution in the world’s biggest car market.

“We believe our solid-state battery technology can be a game changer with the potential to dramatically improve driving range,” Executive Vice President Didier Leroy said at the Tokyo Motor Show, which opened to media on Wednesday.

Toyota plans to roll out a new electric vehicle in the early 2020s powered by solid-state batteries, which also promise to reduce the long charging times currently required.

Although China has heavily promoted electric cars, Japan has outlined plans to pioneer a hydrogen-fueled society.

Leroy noted that Toyota was introducing two new fuel-cell vehicles at the motor show, including the six-seater “Fine-Comfort Ride” concept car, with a cruising range of about 1,000 km (620 miles).

A production version of the second model, the “Sora” fuel-cell bus, will be launched next year, with more than 100 expected to be sold, mainly in Tokyo, ahead of the 2020 Olympic and Paralympic Games to be held in the city.

News Source: Reuters

Read MoreReuters/25 October 2017

SEOUL (Reuters) – Pressed by Seoul into a land swap deal needed for a controversial new missile defense system earlier this year, South Korean conglomerate Lotte Group had good reason to be skeptical.

Just eight months after reluctantly agreeing to exchange a golf course in the country’s south for a piece of land near Seoul, Lotte’s decade-long strategic push into China is now in tatters, raising major doubts about its growth prospects.

The retail-to-chemicals giant is the highest profile corporate casualty of a diplomatic spat between Beijing and Seoul over the U.S. THAAD missile defense system.

Now shunned in China because of the golf course deal, Lotte is expected to sell its Chinese hypermarket stores for a fraction of what it invested. Its plans for mega shopping complexes are indefinitely suspended and its businesses in South Korea that counted on big-spending Chinese customers, from ice cream to tourism, are struggling, officials and investors say.

One Lotte executive said South Korea’s fifth largest conglomerate is now looking for acquisition opportunities such as food companies in emerging markets including India and Myanmar.

But investors and corporate experts say no other market can easily replace China or the promise it once held.

“This is one in the eye for Lotte,” said Park Ju-gun, president of corporate watchdog CEO Score in Seoul. “The group needs to revamp its strategy. It could squeak through by doing more in Southeast Asia, but China is a tough market to replace for a retailer.”

CAN‘T SAY NO

Another Lotte official said the group was trying to boost its chemicals business which currently accounts for a quarter of group sales.

But investing heavily on chemicals will make Lotte’s earnings much less predictable given the volatility of global commodity prices, said Heo Pil-seok, chief executive officer of Midas International Asset Management Ltd, whose firm manages 9.4 trillion won ($8.32 billion).

Embroiled in a high-profile family succession feud and a corruption probe, Lotte agreed to a government proposal in February to provide land for the installation of the Terminal High Altitude Area Defense (THAAD) system.

“We agonized over whether to accept the government’s proposal,” another Lotte official told Reuters on condition of anonymity because of the sensitivity of the matter.

“But we were not able to say ‘No’ because it was related to national security. If we say no to the government, we can’t do business in Korea.”

A Defense Ministry spokesman said the land deal was done within a legal framework and in consultation with Lotte.

WIDENING LOSSES

THAAD was installed to counter the missile threat from North Korea but angered Beijing, which says it upsets the regional security balance.

Since the THAAD deployment, tour operators say China has banned groups travelling to South Korea, while cruises have erased Korean ports from their trips and some flights have been cut.

Nearly all of the 112 Lotte Mart stores in China were shut for much of the year over alleged fire safety issues, and the group has now put the business on the block.

Bankers say it is likely to fetch only a couple of hundred million dollars, a fraction of some 1.9 trillion won ($1.68 billion) Lotte invested in the business.

Lotte’s construction and financing arms also took a hit after building was indefinitely suspended on multi-billion dollar shopping and entertainment complexes in Shenyang and Chengdu in China.

Hotel Lotte, whose mainstay duty free business suffered from a plunge in the number of Chinese travelers, posted its first operating loss in the first half since earnings data was first publicly available in 2008.

Plans for an IPO of Hotel Lotte have been delayed indefinitely, partly due to the THAAD fallout, although a restructuring of Lotte’s four retail and food affiliates into one holding company, which includes a stock market re-listing on Oct. 30, is going ahead.

Kim Ho-seop, an analyst at Korea Investors Service, the Korean branch of Moody‘s, cautioned that the new holding company, Lotte Corp, would face headwinds from deteriorating China business as well as falling profitability at home.

In the long term, Lotte is still hoping its China business will rebound, and the decision to sell its hypermarkets there doesn’t mean it is quitting the market, spokesman Lee Byung-hee said.

LITTLE HELP

The government of President Moon Jae-in in September allowed companies hit by the THAAD backlash to defer their taxes but no assistance to restart crippled China businesses was provided.

And while Seoul boosted funds at policy banks to help affected auto parts suppliers, no additional financing was offered to Lotte.

“The government may announce additional measures to ease the pain later on, but it would be unrealistic to expect relief for a specific company,” said a government official who declined to be identified.

Investors are losing confidence, with shares in Lotte affiliates under-performing the wider market.

While pulling back from China will cap losses in the short term, Lotte’s plan to break into other markets could prove as challenging, according to some investors.

“For retailers like Lotte, expanding its Indonesia and other Southeast Asia business carries risks that are just as big,“ said Heo at Midas International. ”Many tend to underestimate cultural differences and other social differences unique to each country.”

($1 = 1,133.3000 won)

News Source: Reuters

Read MoreReuters/25 October 2017

SAN FRANCISCO (Reuters) – Twitter Inc (TWTR.N) said on Tuesday it would add labels to election-related advertisements and say who is behind each of them, after a threat of regulation from the United States over the lack of disclosure for political spending on social media.

Twitter, acting a month after Facebook Inc (FB.O) launched a similar overhaul of political ads, said in a blog post it would start a website so people could see identities of buyers, targeting demographics and total ad spend by election advertisers.

Silicon Valley social media firms and the political ads that run on their websites have generally been free of the disclaimers and other regulatory demands that U.S. authorities impose on television, radio and satellite services.

Calls for that to change have grown, however, after Twitter, Facebook and Alphabet Inc’s (GOOGL.O) Google said in recent weeks that Russian operatives and affiliates bought ads and used fake names on their services to spread divisive messages in the run-up to the 2016 U.S. presidential election.

Russia has denied interfering in the election.

Citing Russia-linked ads, Facebook last month said it for the first time would make it possible for anyone to see any political ads that run on Facebook, no matter whom they target.

The attempts at self-regulation by Facebook and Twitter have not satisfied lawmakers.

U.S. Senator Amy Klobuchar said in a statement that Twitter’s announcement was “no substitute for updating our laws.” A Democrat, she is co-sponsoring legislation that would make disclosures mandatory.

Twitter said its changes would take effect first in the United States and then globally.

The new approach to ads would be visible in people’s Twitter feeds, where election ads would have the label “promoted by political account,” the company said.

“To make it clear when you are seeing or engaging with an electioneering ad, we will now require that electioneering advertisers identify their campaigns as such,” Bruce Falck, Twitter’s general manager of revenue product, said in the blog post.

Twitter said it would limit targeting options for election ads, although it did not say how, and introduce stronger penalties for election advertisers who violate policies.

The company said it would also allow people to see all ads currently running on Twitter, election-related or otherwise.

Twitter’s latest move would not tackle its longstanding problem with fake or abusive accounts that some users and lawmakers also blame for influencing last year’s U.S. election. Unlike Facebook, Twitter allows anonymous accounts and automated accounts, or bots, making the service more difficult to police.

Transparency by itself “is not a solution to the deployment of bots that amplify fake or misleading content or to the successful efforts of online trolls to promote divisive messages,” Representative Adam Schiff, the top Democrat on the House Intelligence Committee, said in a statement.

Twitter said last month it had suspended about 200 Russia-linked accounts as it investigated online efforts to influence last year’s election.

The general counsels for Facebook, Google and Twitter are scheduled to testify next week before the Senate and House intelligence committees.

Reuters/25 October 2017

HIROSHIMA, Japan (Reuters) – In the high-stakes, high-cost battle among global automakers to develop ever more efficient vehicles, one of the biggest breakthroughs in internal combustion engine technology in years looks to be coming from one of the industry’s smaller players.

Japan’s Mazda Motor Corp (7261.T) has zoomed past its larger global rivals to develop an engine which ignites gasoline using combustion ignition technology, a fuel-saving process considered something of a holy grail of efficient gasoline engines.

As global emissions regulations get tougher, not only could Mazda’s technology prolong the life of internal combustion engines, it could also improve “greener” engines as they can be used to produce more efficient gasoline hybrid and plug-in hybrid vehicles.

Mazda will showcase the Skyactiv-X technology at the Tokyo Motor Show this week. When it launches the engine in 2019, the automaker says it will deliver as much as 30 percent fuel efficiency over its Skyactiv-G engine, already one of the most fuel efficient gasoline engines on the market.

“Our resources are limited, so unlike bigger automakers, we don’t have the array of options in which to invest our R&D funds,” said Mitsuo Hitomi, managing executive officer at Mazda who oversees engine development. “That’s why we’re betting on this technology … We were determined that no matter what, we would develop this engine,” Hitomi told Reuters in an interview at the company’s headquarters in Hiroshima.

Churning out around 1.6 million in annual vehicle sales, Mazda accounts for only a sliver of global car sales, and its R&D budget is roughly a tenth that of automaking giant Toyota Motor Corp (7203.T).

Many automakers with big spending budgets have invested heavily in developing a host of new powertrain technologies, including gasoline hybrids, battery electric cars and fuel cell vehicles, as fuel efficient alternatives to gasoline and diesel vehicles.

But Mazda believes fuel-sipping engines are a better way to reduce carbon emissions than cars powered by fossil fuel-generated electricity, focusing on the Skyactiv-G high-compression gasoline engine, and its diesel cousin, the Skyactiv-D.

Its latest technology is a variant of homogeneous charge combustion ignition (HCCI) technology, which marries the clean-burning qualities of gasoline engines and the fuel economy and grunt of diesel engines to produce an efficient, powerful engine.

PRECISE TIMING REQUIRED

Mazda’s engineering team began developing the engine around the time it completed developing its Skyactiv-G engine, which came out in 2011.

From the start, solving the multiple variables required to balance performance with successful compression ignition was a challenge so complex and frustrating that there were “countless times” the team wanted to throw in the towel, Hitomi said.

Engineers at General Motors (GM.N), Honda Motor Co (7267.T) and other automakers have also pondered how to develop a cost-effective way to control the HCCI process, which requires precise timing inside the engine chamber to achieve efficient ignition.

Hitomi and his team came up with a relatively simple solution — to facilitate sparkless ignition, use a spark plug to light a high-pressure “fireball” inside the chamber to compress the super-lean mix of fuel and air.

The process is controlled by precisely monitoring each movement in the combustion chamber, enabling visibility of when the intake valve allows air to be drawn into the chamber to when the fireball is ignited.

”Kudos to them for taking the next step,” said Paul Najt, Group Manager of Research & Development at GM, which began showing an early HCCI prototype around 2007.

GM has since applied HCCI technologies to develop smaller, turbocharged engines, but Najt said the automaker was not developing a full system at the moment due to cost concerns. In the meantime, it has released gasoline hybrid and other electric models.

‘A MONSTER OF AN ENGINE’

Hitomi said Mazda’s spark plug breakthrough came during a crisis point around two years ago, when the development team showed him an early rendition of the engine.

“It had so many parts to it, like separate controls for variable valve timing and intake and exhaust levels, that it had become a monster of an engine,” too costly to produce, he said.

The team then “performed massive surgery” to simplify the engine, using a spark plug to achieve an even compression ignition process and stripping unnecessary functions.

Now the Skyactiv-X engine consists of just three additional key components compared with the Skyactiv-G: in-cylinder sensors to monitor the combustion process, a high pressure fuel system to create the optimal fuel mix and a supercharger.

The cost of the new engine ”falls somewhere between a gasoline and diesel engine”, Hitomi says.

Massachusetts Institute of Technology Prof. William Green, who has worked with HCCI development teams at U.S. automakers, said Skyactiv-X’s efficiency gains may be limited compared with hybrids and the even larger longer-term potential benefits of EVs.

But the automaker could win over customers looking for an inexpensive, fuel-saving option which does not require battery recharging time or infrastructure, he added.

“It has the advantage of being simple and straight forward, not expensive, and practical. Those are a lot of advantages.”

News Source: Reuters

Read MoreReuters/25 October 2017

LAS VEGAS (Reuters) – The creators of an embattled cybercurrency technology project called Tezos expressed regret on Tuesday about their ongoing dispute with the head of a Swiss foundation that controls the $232 million they raised in one of the largest “initial coin offerings” ever.

In their first public appearance since Reuters detailed the controversy in a report last week, Arthur and Kathleen Breitman described their feud with Tezos Foundation President Johann Gevers over control of the project as unfortunate.

“I mean, it stinks – it stinks,” Kathleen Breitman said while sitting next to her husband on a panel at the Money20/20 technology conference in Las Vegas. “Like, we’re both really embarrassed about the situation, but we trust the process that we put in place and I think it will be resolved in due course.”

The Breitmans helped establish the Zug-based Tezos Foundation to handle their coin offering and develop a new transaction system that the money would be put toward. Under Swiss law, the foundation is supposed to be independent.

However, the Breitmans have been trying to oust Gevers after an extended battle over who controls resources tied to Tezos, and how to use them. Gevers has said he has no plans to leave.

Coins linked to the project, called “Tezzies,” do not yet exist, but contracts on their future value have fallen sharply since the battle came to light.

The dispute has highlighted the risks in the current frenzy over initial coin offerings (ICOs) which have raised more than $2 billion this year. ICOs are an unregulated means of crowdfunding in which a new cryptocurrency is sold to investors in exchange for legal tender or other cryptocurrencies such as Bitcoin to raise funds for startup companies.

Since the Reuters report last week on the dispute, the Breitmans posted a statement online saying Gevers had been “suspended.”

On Tuesday, a spokesperson for the couple said they had been notified that “a majority of the board has asked Johann to be relieved of his operational duties and, to the best of their knowledge, he has been.”

But two of the foundation’s three board members, Guido Schmitz-Krummacher and Gevers himself, told Reuters he cannot be suspended without holding a board meeting, which requires 30 days’ notice. A spokesman for Switzerland’s Federal Department of Home Affairs, which oversees the agency that supervises foundations, confirmed the process.

The third board member, Diego Olivier Fernandez Pons, declined to comment.

In the Tezos fundraising, participants were told they were not making an investment, but a “non-refundable donation” to the Tezos Foundation, which is seeking not-for-profit status.

Regulators around the world have been giving closer scrutiny to ICOs, with the U.S. Securities and Exchange Commission (SEC) stating in July that some of the coins, also called tokens, may be considered securities subject to federal rules and regulation.

A spokeswoman for the SEC declined to comment about Tezos. Swiss financial regulators also declined to comment.

Tezos organizers say its coins cannot be issued until the underlying technology operates. The Breitmans have said their “current best estimate” for the launch is next February, but it will only happen when the computer network is ready.

While the foundation holds all the ICO funds, the Breitmans still control the Tezos source code through a Delaware company called Dynamic Ledger Solutions Inc (DLS). The Tezos Foundation is supposed to acquire DLS, but when that will happen is unclear.

According to the Breitmans, DLS shareholders have up to two years to exercise a contractual option to sell their shares to the foundation. That period begins two months after the network launches. If the option is not exercised, the foundation can buy DLS for up to a year.

Those stipulations, which were not disclosed to the ICO participants, mean it could take more than three years to complete the sale.

During the panel on Tuesday, the Breitmans did not provide an update on timing. The moderator, Meltem Demirors, who invested in the project, asked what they had to say to investors. “Bear with me,” Arthur Breitman responded.

In theory, Tezos would be able to log and process all kinds of transactions in a faster and more secure way than most current systems, using a technology called blockchain that underpins other digital currencies, such as bitcoin.

Some banks and other financial technology companies are also developing blockchain to use not only for cryptocurrency trading but mainstream financial transactions.

Several contributors to the Tezos fundraising interviewed by Reuters expressed concern about the dispute between the Breitmans and Gevers, but most said they were still hopeful the project will succeed.

Emin Gun Sirer, a Cornell University associate professor in the computer science department who is a Tezos technical adviser, said he continues to believe the network is still “technically sound.”

“I hope that they can sort out their issues and start delivering on it,” he said.

News Source: Reuters

Read MoreReuters/24 October 2017

TORONTO (Reuters) – The Canadian government is “really worried” about cyber attacks that have targeted critical infrastructure and has helped companies improve their defenses without disclosing hacks to the public, a senior intelligence official said on Monday.

The comment by Scott Jones, an assistant deputy minister at Canada’s Communications Security Establishment intelligence agency, follows a warning on Friday from the United States that sophisticated hackers are targeting U.S. infrastructure, including nuclear, energy, aviation, water and manufacturing industries.

“Targeted attacks on Canadian infrastructure is something we are really worried about,” Jones said in an interview at the Reuters Cyber Security Summit in Toronto.

“Do we think something’s going to happen tomorrow? No,” Jones said. “Is it technically possible? Yes, and that’s what we’re worried about.”

Jones said Canada had seen a level of hacking activity that was “comparable” to what had been reported in the United States.

Jones said the government rarely goes public when it uncovers hacking activity because that would let attackers know they had been caught. Instead, it quietly reaches out to targeted firms.

“We try to do it very quietly to help the company become more resilient,” he said. “We’d like to try to give the defenders as much advantage as we can.”

Ray Boisvert, a former senior official with the Canadian Security Intelligence Service spy agency, also told the Reuters Cyber Security Summit that defenses against such attacks need to be improved.

Boisvert, who this year began advising the Ontario provincial government on security issues, said that infrastructure firms are not doing enough to thwart cyber attacks.

“We’ve yet to suffer a massive critical infrastructure attack and we’ve yet to suffer a massive loss of capability,” he said, explaining why many firms have not invested in boosting cyber defenses.

He warned that some 60 nations currently have the ability to conduct offensive cyber warfare operations, including ones that could harm the grid and other infrastructure.

Five years ago, only about five nations had that capability, he added.

CSE’s Jones said the potential for cyber attacks to harm critical infrastructure has diminished over the past two years because private companies now take the threat much more seriously.

News Source: Reuters

Read MoreReuters/24 October 2017

WASHINGTON (Reuters) – Former U.S. intelligence officials who worked for both Republican and Democratic presidents urged Congress on Monday to renew an internet surveillance program they said has stopped militant plots and helped policymakers steer through international crises.

The program, authorized under Section 702 of the Foreign Intelligence Surveillance Act, allows U.S. spy agencies to eavesdrop on and store vast amounts of digital communications from foreign suspects living outside the United States. It will expire on Dec. 31 if Congress does not act.

“We have personally reported to our Presidents – Republican and Democratic – and to the Congress details of plots disrupted based on information from Section 702,” the former intelligence chiefs said in letters to congressional leaders that were seen by Reuters.

“We strongly urge the Congress to reauthorize the program and continue allowing the intelligence community to protect our country,” they wrote.

The letter’s signatories include former directors of U.S. national intelligence, the CIA and the National Security Agency; and a former attorney general.

Rights groups, including the American Civil Liberties Union, oppose the law in its current form because it sometimes incidentally collects communications of Americans. Those communications can then be subject to searches without a warrant by the Federal Bureau of Investigation for criminal and national security investigations.

The Senate Intelligence Committee is expected to privately vote on Tuesday on a bill to reauthorize Section 702 that privacy advocates say will largely lack their reform priorities.

Senator Ron Wyden, a Democratic member of the panel, sent a letter on Monday urging committee leaders to allow a vote to take place publicly, saying the bill “will have enormous impact on the security, liberty, and constitutional rights of the American people” and should be debated in the open.

A bipartisan group of lawmakers in the House of Representatives earlier this month introduced legislation intended to install new privacy protections for 702 surveillance, including a partial restriction on the FBI’s ability to access American data that would require agents obtain a warrant when seeking evidence of a crime.

The former spy chiefs’ letter was sent to the Republican and Democratic leaders of the Senate and House, and heads of the Senate and House Intelligence and Judiciary committees.

Implementation of the Section 702 program, they wrote, has received positive reviews from the independent Privacy and Civil Liberties Oversight Board.

The letter was signed by former directors of national intelligence Dennis Blair, James Clapper and Mike McConnell; former attorney general Michael Mukasey; former CIA director John Brennan; former NSA chief Keith Alexander; and Michael Hayden, who led both the CIA and the NSA.

News Source: Reuters

Read MoreThe New York Times/24 October 2017

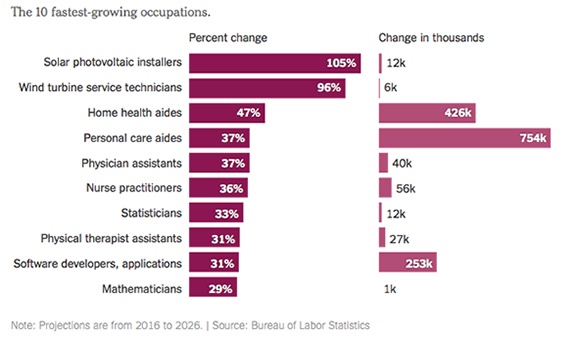

A decade from now, the American economy could look much the way it does today — only more so. More dominated by the service sector amid the continued erosion of manufacturing jobs. More polarized in both earnings and geography. More tilted toward jobs that require at least a bachelor’s degree.

That, at least, is the future foreseen by experts at the Bureau of Labor Statistics. The federal agency on Tuesday released its projections of what the United States employment picture will look like in 2026. (The estimates are based on long-term trends, not the short-term strength or weakness of the economy.)

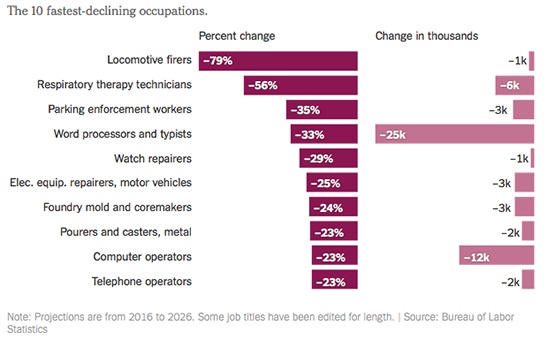

The projections reflect some familiar patterns. Jobs in health care and clean energy will continue to grow rapidly. Manufacturing jobs will shrink, as will occupations involving data entry or other tasks that are increasingly being done by machines or algorithms. Overall job growth will continue to be slow, partly as a result of the aging of the baby boom generation; by 2026, even the youngest boomers will be approaching retirement.

Those trends don’t matter just to economists. The government’s projections, released every two years, are used by school guidance counselors to advise students, by colleges to design curriculums and by work force development agencies to direct displaced workers into training programs.

The projections aren’t perfect. A decade ago, the Bureau of Labor Statistics underestimated the impact of the rise of e-commerce on retail employment, and it projected a big increase in office clerk jobs that, because of automation, never came. But the government’s experts accurately foresaw many of the most important employment trends, including the growth of jobs in health care and computer programming and the continued decline of blue-collar jobs in manufacturing.

Vanishing Job Categories

Tuesday’s report suggests that the polarization that has increasingly defined the United States economy will only increase over the next decade. High-paying jobs in health care, computer science, and other fields heavy in math and science will grow quickly; so will low-paying jobs caring for older adults or waiting on tables. But continuing a decade-old trend, many job categories in the middle of the pay spectrum are growing slowly or disappearing.

Particularly vulnerable are jobs with decent pay that require less than a college degree. And even a bachelor’s degree is no longer a guarantee of success: The greatest job growth over the next decade will be in occupations requiring a graduate or professional degree.

The nation’s geographic divides are likewise expected to become wider. The fastest-growing categories are concentrated in large urban areas, especially on the coasts. Small-town America will most likely continue to struggle. Those economic trends have political ramifications: Occupations expected to shrink over the next decade tend to be in counties won by President Trump in 2016, according to an analysis of the data by Jed Kolko, chief economist of the job-search site Indeed.com.

“Continued polarization is the story,” Mr. Kolko said. “Not just in wages but also in geography and therefore also politics.”

Automation Spreads

Many of the jobs expected to disappear over the next decade are in industrial jobs that have long felt the dual squeeze of globalization and automation: metalworkers, coal miners and machine operators, particularly those without specialized skills.

But the impact of automation is increasingly spreading to the service sector as well. Government economists expect steep declines in employment for typists, telephone operators and data-entry workers. Even jobs that might once have seemed relatively secure, such as legal secretaries and executive assistants, are expected to decline in coming years.

At the same time, technology is creating new opportunities for statisticians, engineers and software developers — the workers developing the algorithms that are changing the global job market.

The Demographics of Change

Men bore the brunt of the first wave of automation. That is changing as the trend shifts to the service sector, however; several of the occupations that are expected to decline in coming years are dominated by women, including many office administrative jobs.

Women may not be net losers in the changing economy, however. Women hold a disproportionate share of jobs in many of the fastest-growing categories. Some of those jobs pay little, such as waitresses and nursing assistants. But women also dominate many well-paid and fast-growing occupations in nursing and physical therapy, among others. And while men are also overrepresented in some growth sectors, they will most likely show slower overall employment growth than women in the years ahead.

None of these patterns, of course, are set in stone. As the economy shifts, social and cultural forces shift with it; men, for example, are increasingly going into fields like nursing that were once seen as women’s work. (Research has found that when they do enter such occupations, men tend to be promoted more quickly than women.) And parts of the country that lost out in the decline of manufacturing are now attracting warehouse jobs tied to online shopping. Such adjustments are happening only gradually, however, even as the economy is changing rapidly.

News Source: The New York Times

Read More